The Disaster Magnates

PG&E is an investor-owned utility. It has a responsibility to its shareholders to maximize their rate of return (ROR) on investment.

However, PG&E is not free to set electricity rates and fees however they please. Rates are set by the California Public Utilities Commission (CPUC) based on an authorized rate of return for the building and maintenance of PG&E’s infrastructure. Electricity rates fluctuate based on energy consumption, so PG&E makes only enough revenue to cover its costs and the agreed upon ROR. In principle, this is good because it removes the incentive for PG&E to sell more energy and encourage higher energy consumption, which results in burning more fossil fuels.

The Revenue Loophole

There is a glaring loophole in this financial structure, though: while revenue is theoretically fixed, a utility’s actual ROR may be higher or lower than what the CPUC has authorized, depending on how the utility manages its costs. Whenever PG&E’s construction and maintenance costs are lower than the budget they submitted, the savings are passed on to shareholders, and they can receive a higher-than-projected ROR. This structure is supposed to incentivize utilities to be fiscally responsible, but in reality it has led to underspending on critical infrastructure upgrades and maintenance for the benefit of shareholders. Lack of upgrades and maintenance have been directly linked to many of the recent wildfires, causing incredible death and destruction.

The shareholders also have a huge interest in not being on the hook for the damages caused by underinvestment in infrastructure. In 2018, PG&E spent nearly $10 million of shareholder money on California lobbying efforts, which was the highest in the state spent by a single entity.

While continuous underinvestment in construction and maintenance was good for shareholders for many years, it has finally caught up to them. Stock prices dropped precipitously in 2018 due to PG&E's liability for wildfire damages and fatalities, and PG&E entered bankruptcy proceedings the following year. The bankruptcy filing removed PG&E from stock indexes, which forced mutual-fund managers like BlackRock Inc. to sell their stocks at a loss. Some funds, like BlueMountain Capital and the Baupost Group, misjudged just how far PG&E would fall and had to take big losses because of it.

Vulture Capitalists

However, that opened up an opportunity for a different group of investors to swoop in and take advantage of the historic price drop. Three hedge funds in particular — Abrams Capital Management, Knighthead Capital Management, and Redwood Capital Management — bought about 10 percent of PG&E shares (45 million shares) in January after PG&E declared its intention to file for bankruptcy and the stock dropped from $24 to $6 per share. The stock later bounced back to around $20 a share, with hedge funds looking at an unrealized gain of more than $500 million.

- Boston’s Abrams Capital Management defines their investment strategy as “opportunistic” with a focus on “distressed securities […] and/or illiquid investments.”

- Knighthead is a New York–based firm that “specializes in event driven, distressed credit and special situation opportunities across a broad array of industries.”

- Redwood Capital Management is an “investment advisor that focuses primarily on distressed and stressed credit opportunities.”

These firms look for situations like the PG&E bankruptcy to make an absolute killing on their investments, while the public are literally paying with their lives.

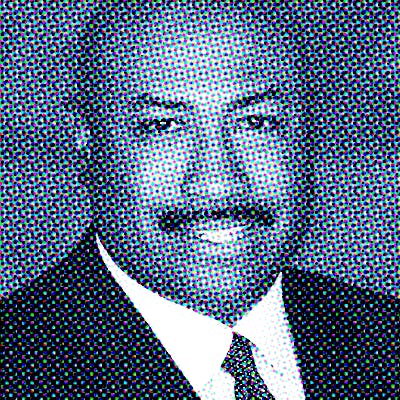

PG&E's Shareholders

PG&E management, now serving a new set of shareholders, directly coordinated with these firms in selecting its next CEO and board of directors. While the proposed board members were not publicly disclosed, Gov. Newsom’s office said in a letter to PG&E management: “I am troubled to learn that PG&E is primed to reconstitue its board with hedge fund financiers, out-of-state executives, and others with little or no experience in California and inadequate expertise in utility operations, regulation, and safety.”

Even with the protests of the governor, the 14-member board that shareholders will be voting to approve on June 21, 2019 still includes five that come from the investment-banking sector.

These board members have a history of working with distressed companies and those undergoing restructuring, and they will have a mandate to make creditors and investors as much money as possible and try to pass losses on to ratepayers and the pubic. They were selected to ensure that shareholders recoup their investments, even if that means that fire victims are not compensated, electricity rates go up, infrastructure continues to break down, and fossil fuels continue to burn.

As long as PG&E remains an investor-owned utility, the profits of shareholders will be prioritized while the public suffers the consequences. However, the bankruptcy proceedings are a unique opportunity for a new and just vision for our electric utility. We need a public takeover so that together we can set priorities of safety, reliability, accountability, and environmental protection.